One of the exciting parts about having a regular job is having a regular paycheck which means I can create a regular savings plan. Retirement is the biggest goal, but in reality, I think the goal is really about creating enough passive income that I don’t have to work anymore. Retirement (i.e. 65) just adds the time component to that goal, but I would be fine if I could hit that goal by 55 or even 35 (dream big, right?). So now that I have $100-200 per month to invest, what do I do with it? This isn’t really something they cover in school…

My goals are three-fold:

- Keep costs low. Money I pay in expenses can’t be otherwise invested and grow.

- Easy to make into a habit. They say that consistently putting away money is more important than almost anything else in your investment strategy.

- Simple enough I can explain it to my wife. Basically the KISS rule.

Because I am trying to invest a little bit of money each month, most “exotic” things (like buying real estate or opening a Tim Horton’s) are out because they require a big chunk of change up front. The thing that rises to the top is individual stocks, since you can, in theory, buy a share one at a time for $10-200 each.

Let me take a moment to talk about diversity. In investing, the recommendation often comes up to diversify. What that means is not to bet everything on the same thing. In stocks, for example, this means buying many stocks, so that if one particular company goes bankrupt, you don’t loose everything. Another way to diversify is to invest in things that react to the markets in different ways; this is often the source of the advise to invest in both stocks and bonds. This can also be achieved by investing in different parts of the global economy. The two most common ways for the “little guys” (like me) to get diversity in their portfolios are mutual funds and index funds.

Mutual funds are a way of group investing: everyone pays into a pool, hires an expert with that money to manage and invest the rest of it, and everyone cross their fingers and hopes to get rich. (This is sometimes called “active management”). But the question becomes how much do you have to pay that expert? When your look into the paperwork provided by the mutual fund, you’ll finds something called the M.E.R. or Management Expense Ratio. This number, as a percentage of the total pooled money, is what you’re paying to that expert running the fund. In my experience, the MER is often over 2% and can be close to 3%! That means the market has to go up 3% each year just for you to break even (after you pay your ‘expert’)! Maybe in the 1990’s when the market was doing exceptionally well, this was easy to ignore, but in the last few years with the market stalling, that seems like a very heavy price.

So let’s talk about index funds. Index funds exist to track an ‘index’ or a stock market (like, New York, Toronto, London, etc). This means an index fund owns a little of every stock on the exchange; here you have your diversity. Once the ground rules are set, you don’t really need an expert to run the fund like a mutual fund, and so the MER is less than 1%, often around 0.5%. Compounded over a number of years, the difference in MER can be huge! However, index funds are often sold as ETF’s (“Exchange Traded Fund”) which means you buy them on a stock market, but you have to pay a broker for the privilege. The brokerage charge varies, but I’ve seen it listed from $7 to $20. This brokerage charge is what makes it impractical for me personally to try and just buy hundreds of stocks to make my own ‘index fund.’

So Index Funds are (typically) much cheaper than Mutual Funds once I hold them, but Index funds cost something to buy and sell (with Mutual Funds, this cost is covered by the MER). If my portfolio was big enough, those brokerage fees would become a rounding error, and I could just ignore them and buy EFT’s. However, if I’m investing $100 a month, those brokerage fees become huge!

Enter commission free EFT’s! I discovered Scotia iTRADE has a list of 50 commission-free EFT’s that they offer. (I have since discovered Qtrade offers a similar list of EFT’s.) And the fact that they only offer 50 funds is probably just as well because it simplifies my investing choices. So I set up an account with iTRADE. The experience was a little annoying and convoluted. It involved a call, filling out a form online, printing out said form, and then mailing it with a copy of my ID and a cheque for $1. But I have an account now!

Based on the above, I want EFT’s that give me exposure to to Canada, possibility the States but mostly to balance out sectors that aren’t well represented in the Canadian market, other economies that aren’t likely to move the same way as Canada but are relatively stable, and something that will provide a counter to stocks, possibly in the above markets. Let’s look at the ETF’s offered. First, for the Canadian market:

- CRQ — Claymore Canadian Fundamental Index — MER of 0.71% — models the TSX but includes more factors than simply capitalization; part of the idea is to counteract companies that are under- or overvalued

- HXT — Horizons S&P/TSX 60 Index ETF — MER of 0.07% — a “synthetic ETF,” meaning they don’t actually own all of the stocks, but that helps keep the MER low; this fund includes the 60 biggest (by capitalization) stocks on the TSX, representing 71% of the TSX by market capitalization; the fund doesn’t typically pay much in dividends

- XMD — iShares S&P/TSX Completion — MER of 0.58% — everything on the TSX but the top 60 stocks

For the American market:

- CLU — Claymore US Fundamentals — MER of 0.72% — includes more factors than simply capitalization; part of the idea is to counteract companies that are under- or overvalued; based on the model used, the 1000 biggest firm in the United States are selected - available as a Canadian hedged version as well (CLU.C)

- HXS — Horizons S&P 500 IDX — MER of 0.15% — a “synthetic ETF”; “includes 500 of the leading companies in leading industries in the United States economy” — this fund in Canadian hedged

For investing in international markets, there are funds targeting China, Japan, “Emerging Markets,” the BRIC economies (Brazil, Russia, India, and China), Latin America and international markets generally. Notably missing from that list is Europe…. I don’t really know anything about these specific markets to pick a winner, so I’ll just consider the general international funds:

- CIE — Claymore International Fundamentals — MER of 0.73% — models the FTSE RAFI Developed ex US 1000 Index which includes more factors than simply market capitalization and covers companies not listed on American exchanges; by percentage of the index, Canada represents 6%, the UK at 19%, France at 12 %, Japan at 16 %, Australia at 5% among others; in terms of sectors Oil & Gas is at 10 % and Banks at 16% (more details).

- VEF — Vanguard MSCI EAFE Index ETF — MER of 0.37% — tracks the MSCI EAFE which invests “primarily in stocks of companies located in Europe, Australia, Asia and the Far East and uses derivative instruments to seek to hedge the foreign currency exposure of the securities” so basically the ‘developed world’ minus Canada and the United States; the fund includes 981 stocks; by percentage of the index, the UK represents 21%, France at 11%, Germany and Switzerland at 8% each, Japan at 24%, Australia at 7%; in terms of sectors Financials is at 24% and Oil & Gas at 9% (more details); the fund seems to invest heavily in the American version of this fund; this fund is Canadian dollar hedged.

Bonds are a debt holding that will return you both it’s principal at the end of the term as well as interest while you hold the bond. I’m a little bit leery of bonds at the moment because yields are low and their liquid price tends to drop as interest rate raise (and interest rates, being what they are today, really can’t go down any further…) To provide income, a couple of other options include preferred shares, dividend paying stocks, and trusts (like REIT’s or Real Estate Investment Trusts).

- CLF — Claymore 1-5 Year Laddered Government Bonds — MER of 0.17% — annual dividend of about 4%, yield of 20%

- CBO — Claymore 1-5 Year Laddered Corporate Bonds — MER of 0.28% — annual dividend of 4.5%, yield of 22%

- CAB — Claymore Advantaged CND Bond Index — MER of 0.33% — annual dividend of 3%, yield of 15%

- CHB — Claymore Advantaged High Yield Bond — MER of 0.56% — annual dividend 7.5%, yield of 36%; this is “non-investment grade bonds”

- CSD — Claymore Short Duration High Income — MER of 0.63% — annual dividend of 5%, yield of 2.5%; both investment and non-investment grade bonds with a duration of less than 5 years

- CBD — Claymore Global Balanced Income — MER of 0.71% — annual dividend of 3%, yield of 16% - holds a selection of other Claymore ETF’s

- CPD — Claymore S&P/TSX CND Preferred Share — MER of 0.50% — annual dividend of 5%, yield of 28%

- CDZ — Claymore S&P/TSX CND Dividend — MER of 0.67% — annual dividend of 3%, yield of 15%; follows the S&P/TSX Canadian Dividend Aristocrats Index

- FIE — Claymore Canadian Financial Monthly Income — MER of 1.00% — annual dividend of 7.5%, yield of 114%; aims to provide a monthly cash distribution of 4 (or 5?) cents per share (or 6% annually, based on the current share price); investments focus on the Canadian financial sector

- CYH — Claymore Global Monthly Advantaged Dividends — MER of 0.83% — annual dividend of 4%, yield of 28%; tracks an index of global dividend stocks but the index’s methodology is not published; the index is diverse, with no stock making up more than 2% of the index; the ETF uses a “forward agreement” where it doesn’t directly own the stocks of the index, but gives you the returns as if it did, this is done for tax reasons - “dividends” actually come as return of capital or capital gains rather than foreign (American) dividends; MoneySense has a good profile of the EFT.

- CUD — Claymore S&P US Dividend Growers — MER of 0.60+% — annual dividend of 2.4%, yield of 11%; follows the S&P High Yield Dividend Aristocrats CAD Hedged Index; the index is a collection of US stocks that have raised dividend for the last 25 years with limits on minimum size and stock liquidity; I’ve read about the index and I guess historically it’s done pretty well in the past, but during the economic problems of 2008 a lot of the top performers cut dividends (temporarily) and got dropped from the index

- I wish there was an EFT that allowed me to invest in Canadian REIT’s…

- I guess another option in this category is my student loan which allows me to make extra payments and charges 5.5% interest currently; it’s not nearly as sexy as having money in the market, but it still may be the best choice; the only complication is it won’t show up in my account balance which makes figuring out sector balancing a little more complicated. Part of the idea to making student loans work is to then invest the payments at the end that I would have had to make but now don’t because I paid off the loan early.

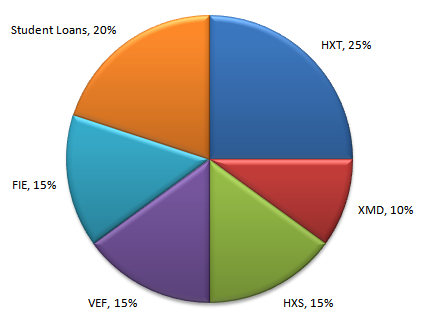

Ok, so now for my selections. For Canada, I’ll go with the combination of HXT and XMD, roughly in proportion to the market cap of the indexes they follow (71%-29%). For international, I’ll use HXS for American exposure and VEF for the rest of the world, in roughly equal proportions. For bonds/income, the 5.5% I pay on my student loan is hard to beat without ‘high risk’ (i.e. non-investment grade bonds), so I’ll put some into my student loan and some in FIE (currently a dividend return of 7.5%), in roughly equal proportions. I decided to wight the three sectors equally, and so then with a little bit of rounding to make ‘even’ numbers, I get:

- HXT - Horizons S&P/TSX 60 Index ETF - 25%

- XMD - iShares S&P/TSX Completion - 10%

- HXS - Horizons S&P 500 IDX - 15%

- VEF - Vanguard MSCI EAFE Index ETF - 15%

- FIE - Claymore Canadian Financial Monthly Income - 15%

- Student Loans - 20%

Overall, the portfolio would have a weighed MER of 0.30%.

As I’ll be putting money in regularly, I’ll use the regular purchases to try and maintain the ratio, hopefully without having to do too major of re-balancings. As well, if a fund seems to be close to it’s 52 week high, I’ll consider whether to wait to buy the fund. I also need to keep tabs on the FIE dividend rates, and consider options if it falls much under 5.5% (i.e. what my student loans cost). I’m also going to keep an eye out for options to invest in REIT’s.

One last thing is tax planning. I’ll be investing for now in a TFSA. This requires me to invest with post-tax dollars, but any gains are tax free. As well, I can withdraw at any time without penalty. As for RRSP’s, my contribution room carries forward, and I hope to end up in a higher tax bracket where the RRSP tax deduction will have a better return.

Comments

Mutual funds usually have a fee, maybe up to 5% to purchase. This might be front end meaning you pay it when you purchase the fund, or back end meaning you pay it when you sell the fund. The back end usually reduces over time so if you hold onto the fund for several years it reduces to zero. Do the EFT's have similar fees?

Just the brokerage fees, which you pay to both buy and sell. At a discount brokerage (i.e. most online ones), this is a flat fee of $7-20. A big reason why I choose these ETF's through iTRADE is I can buy and sell them for free (with one condition: I hold them for at least a day).

So what I have set up involves no purchase or selling fees. :)

Watching stocks, 401k, ECT for several years now, the most beneficial investment I've seen is just paying off existing debts. This has a much higher guaranteed return, and slowly frees up additional resources. Then you can get fancy. ~Chris R

Great post. I do the exact same thing, but with CLF (20%) and CBO (5%) instead of student loans. The lack of commission for buying and selling is perfect for investing a small amount on a regular basis.